The first quarter of the new year is here, and with it comes that feeling of a fresh start that we all love. It’s the perfect opportunity to build on the strong financial foundation you've already established and make 2025 your most successful year yet. Whether you're looking to elevate your existing strategies or create a plan for the first time, Q1 is about having a plan to ensure you’re on the best possible path to reach all of your goals. Here are the top 10 things to focus on in Q1 to take your financial journey to the next level.

1. Review and Adjust Your Financial Goals

A new year is the perfect time to revisit your financial goals. Are you trying to save for a house, pay off credit card debt, or invest for an early retirement? Take a moment to evaluate your quarterly financial goals and make sure they align with your bigger plans. Life can change fast, and the goals you set last year might not be as relevant now. Adjust your budget and savings targets to fit what you want out of 2025 and beyond. Set financial goals that are realistic and aligned to what you care about the most. It’s helpful to have a clear grasp of your needs versus wants. Be intentional with how you classify goals and the tradeoffs you are willing to make.

It also helps to categorize your goals into short-term, medium-term, and long-term. Short-term goals might include saving for an upcoming vacation or paying off a small credit card balance. Medium-term goals could be saving for a down payment on a home or buying a car, while long-term goals might include retiring early or funding a child's education. For example, a realistic short-term goal could be saving $15,000 in an emergency fund over the next three months, a medium term goal could be saving $100,000 for a down payment over the next 3 years, and a long-term goal might be to contribute enough to your retirement accounts to retire comfortably by age 60. By clearly defining and categorizing these goals, you can manage your resources better, ensuring each financial goal gets the attention it needs.

Goal Examples

2. Audit Your Retirement Contributions

Q1 is the ideal time to check in on your retirement plans. Make sure you're maximizing any employer match programs and contributing enough to meet your retirement goals. If you’re not sure of how much you’ll need to retire, use a Retirement Calculator to help plan. A good rule of thumb is to contribute at least 10-15% of your income toward retirement, but this can vary based on your age and financial situation. For example, younger individuals might start with a lower percentage and increase it over time, while those closer to retirement may need to contribute more. Look at your 401(k), IRA, or other retirement savings accounts and adjust your contribution rates if you can afford to save more. If you received a raise recently, consider putting some of it toward retirement. Even a small increase can make a big difference over time—compound interest will work its magic, and your future self will be grateful.

Consider setting up an automatic transfer from your checking account to your retirement accounts every month. Automatic transfers make saving for retirement a breeze by eliminating the need to think about it each month. It's also a good time to evaluate your investment options within those accounts. Are you investing in a mix that matches your risk tolerance and goals? Make sure your investment strategy is aligned with your long-term goals and provides the growth potential you need for the future.

3. Optimize Your Tax Strategy

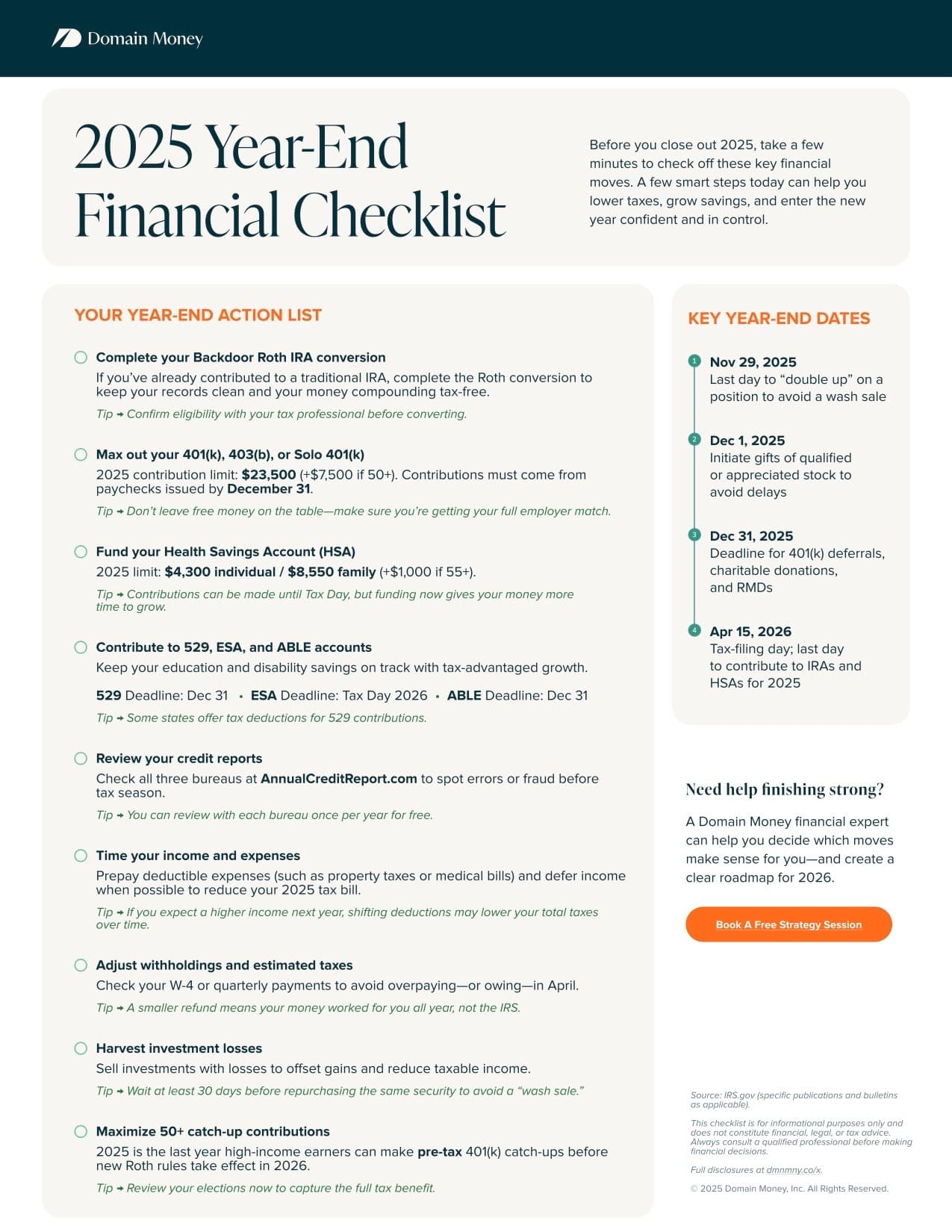

Tax season might feel intimidating, but Q1 is the best time to prepare. Gather all your tax documents, identify potential deductions, and make sure you’re not leaving any money on the table. If you're self-employed or a freelancer, consider making an estimated tax payment to avoid surprises in April. Contributions to traditional IRAs or HSAs can reduce your taxable income, so think about adding to those accounts if it makes sense for your tax situation. Taking the time to optimize your tax strategy now can save you money and reduce stress later.

Don't forget about important upcoming tax deadlines, like the April 15th filing deadline for individuals or the estimated quarterly tax payment deadlines for freelancers. Mark these dates on your calendar to avoid last-minute stress.

This is also a great time to check if there are any tax credits or deductions you qualify for. Credits for energy-efficient home improvements or deductions for student loan interest can help reduce your tax bill. If your situation is complex, getting advice from a tax professional can make a huge difference. They can offer personalized guidance and help you identify strategies to lower your tax burden. Tax optimization is about more than just filing your return—it’s about making smart choices throughout the year that can lead to significant savings.

4. Revisit Your Monthly Budget and Spending Habits

The beginning of the year is also a perfect opportunity for a deeper review of your spending trends and habits. Look back at last year’s expenses and see if any patterns stand out. Did you spend more than expected on dining out? Have those one-click Amazon purchases started to add up? Are you paying for subscriptions you don’t use? It’s all about creating a system that maximizes your cashflow and still gives you the ability to spend on what you care about the most.

Once you have a clearer picture, adjust your budget for the new year. Automate your investing and savings where possible—segment your accounts by specific goals (i.e. travel vs. emergency vs. retirement funds) and use automatic transfers to keep you on track toward each one.

Budgeting doesn’t need to be complicated. Start by listing your monthly income and fixed expenses—things like rent or mortgage, utilities, and insurance. Then allocate money toward variable expenses like groceries, transportation, and entertainment. Be sure to include savings and debt repayment as part of your budget.

Tracking your spending can be as easy as using a budgeting app or spreadsheet to categorize expenses. Popular budgeting apps like CoPilot, YNAB (You Need A Budget), or Monarch Money can automate a lot of the process and help you visualize trends. The goal is to understand where your money is going and make real-time adjustments to your lifestyle if necessary.

5. Set or Replenish Your Emergency Fund

Best practice is to have three to six months’ worth of expenses saved in a high yield savings account. If you had to dip into your emergency fund recently, Q1 is the perfect time to start replenishing it. If you haven’t started one yet, make it a priority to start building it this year.

Consider setting up an automatic transfer to your emergency fund to make saving easier and more consistent. Financial wellness isn’t just about investments and retirement—it’s about being prepared for life’s surprises. An emergency fund gives you the cash you need for unexpected expenses, helping you avoid going into credit card debt.

An emergency fund is meant to cover things like medical bills, car repairs, or even job loss. Keep your emergency savings in an accessible account, so you can easily access the money when needed (we like any FDIC-insured, high yield account with the ability to bucket your money by goals). This way, you won’t have to rely on credit cards or personal loans to cover basic needs during a crisis.

6. Review Your Debt Repayment Plan

Paying off debt can feel overwhelming, but Q1 is the time to face it head-on. Review all your debts—credit cards, personal loans, unsecured debt, student loans—and see if your repayment strategy is still working. Are you using the debt snowball or avalanche method? No matter which method you choose, consistency is what counts.

Try to make at least one principal-only payment each year, as this can shorten your repayment timeline and save you money on interest. Also, check your credit score to see how your efforts are paying off. A higher credit score could mean better opportunities to refinance at a lower interest rate, which can lead to reducing the amount of interest you pay.

7. Evaluate Your Investment Portfolio

If you have investments—whether in the stock market, mutual funds, or other assets—Q1 is the right time for a portfolio check. Look at how your investments performed last year and see if any changes are needed. Are you overly concentrated in one asset class? Has your company’s stock price soared and it might be time to take some profit off the table? Diversification is key, and keeping your portfolio in line with your goals helps reduce risk while maximizing growth. If you’re unsure, consider getting guidance from a financial advisor.

It’s also important to look at your investment accounts as a whole. Are you contributing enough to meet your long-term goals? Are there opportunities to increase contributions or rebalance your portfolio? If you’re investing for a short-term goal, make sure your investments are appropriate for that timeline. High-risk investments might not be the best choice for short-term goals. Keeping your investments aligned with your goals and making adjustments as needed is crucial to staying on track.

8. Plan for Major Expenses

Are you planning to buy a car, take a big trip, or renovate your home this year? Now’s the time to plan for those major expenses. Break down the cost into monthly savings goals, so you’re ready when the time comes. Know what account(s) you’ll use as a source of the funds. It’s much easier to save for big purchases when you start early and have a clear target. Plus, planning ahead means you’re less likely to use credit cards or personal loans when the time comes.

Think about creating a separate savings account for each major expense. This way, you can easily track your progress and stay motivated as you work toward each goal.

9. Set Up a Savings Challenge

If you’re competitive and want to gamify savings, consider doing a quarterly savings challenge. Challenges can help keep you motivated, especially if saving feels like a chore. Set a target amount to save by the end of Q1, and track your progress.

Another idea is to use “found money” to boost your savings. Whenever you get extra cash—like a tax refund, work bonus, or a cash gift—allocate a preset percentage of it into your savings account. This can help you reach your goals faster without affecting your regular budget.

Popular Savings Challenges

- 52-Week Challenge: Save an increasing amount each week (e.g., $1 in week 1, $2 in week 2).

- Pantry Challenge: Stop eating out and buying new groceries for 1 month. Instead, you use up all of those rainy-day cans you’ve been storing and empty your freezer too.

- Cancel ALL your subscriptions: Try living without them as long as possible. If you really miss any of them, you can always re-subscribe (and often with some type of promo incentive).

- Round-Up Savings: Use an app like Acorns to round up purchases and save the spare change.

10. Check Your Insurance Coverage

Insurance might not be the most exciting part of your finances, but it’s essential to your overall financial health. Review your existing policies—home, health, auto, life—and make sure you have the coverage you need. Life changes like buying a home, having a child, or getting married might mean you need different coverage. Make sure your beneficiaries are updated, and ensure you’re not overpaying for policies you don’t need anymore. It’s also worth shopping around to see if you could save money by switching providers.

Moving Forward in 2025

Taking these steps in the first quarter will set you up for a strong financial year ahead. Whether you're optimizing your tax strategies, reviewing your savings rate, or planning for major expenses, it’s all about taking proactive steps and having a plan. Remember to celebrate the small wins along the way—personal finance is a journey, and every positive step counts. So grab a notebook, start tracking your progress, and make 2025 your best financial year yet!

.jpg)

.webp)