Planning for retirement can be complex, but tools like an Roth IRA calculator make it simpler to pick the ideal retirement savings method for your situation. An IRA calculator allows you to compare how using a Traditional IRA vs. Roth IRA can impact your future retirement account balance and potential tax savings. Whether you're considering opening an IRA or you've been contributing for years, this tool will help you understand which retirement method can help maximize your future wealth.

Why Use an Roth IRA Calculator?

An IRA calculator is designed to help you project the future value of your account and potential tax savings available with a Traditional vs. Roth IRA, based on factors such as:

- Current Age: The earlier you start, the more time your investments have to grow.

- Annual Contributions: The amount you contribute yearly, which is capped by IRS limits.

- Expected Rate of Return: Your investments' annual return will be. For reference, the S&P 500 has historically returned 9.9% (7.22% when adjusted for inflation) over the last 30 years (source: https://www.macrotrends.net/2526/sp-500-historical-annual-returns)

- Years to Grow: The number of years before you plan to retire.

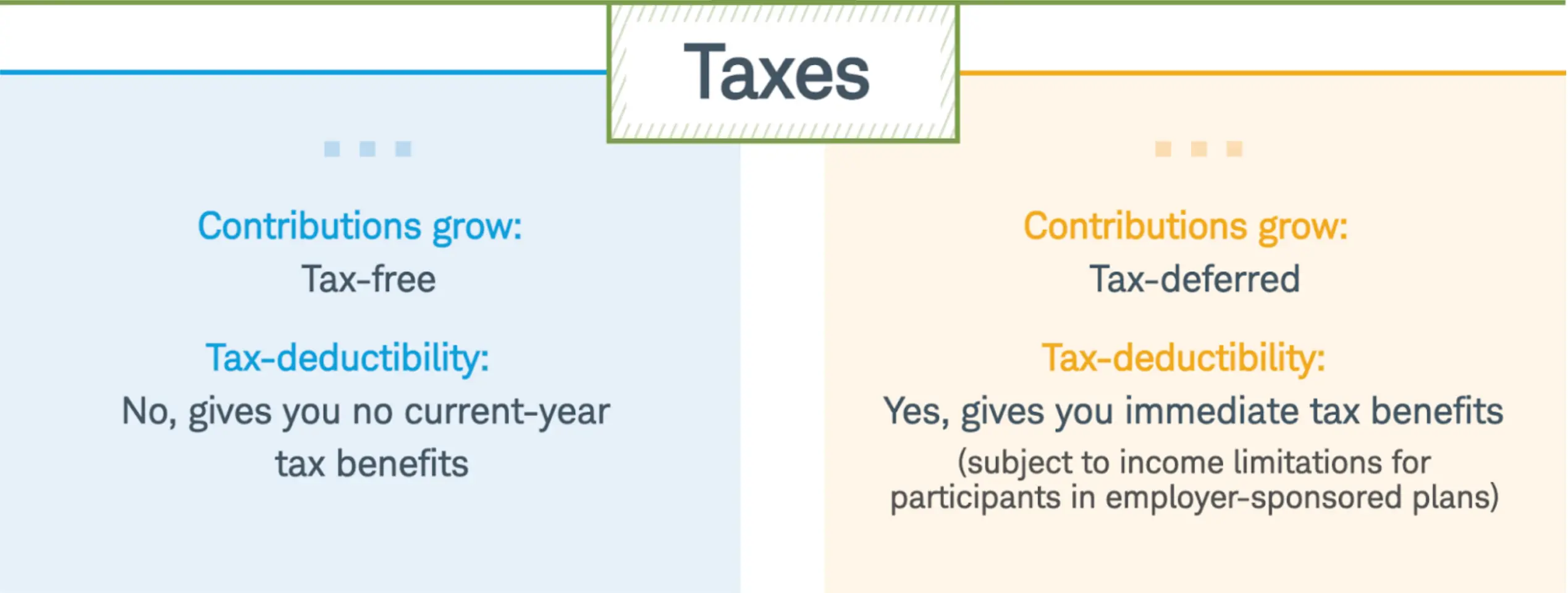

- Tax-Free Growth: Understand the tradeoffs between making after-tax or pre-tax contributions as it relates to account growth and taxation:

Key Factors to Consider

1. Contributions

- Taxes

3. Withdrawals

How an Roth IRA Calculator Works: Step-by-Step Guide

1. Gather Necessary Information

Before using the calculator, have the following details handy:

- Current Roth IRA balance (if any)

- Current Traditional IRA balance (if any)

- Current income and tax bracket

- Annual contribution amount

- Estimated rate of return

- Number of years until retirement

2. Input the Data

Most calculators allow you to enter:

- Initial balance: The total amount of money you currently have saved or available to invest in your retirement account. This includes any previous contributions and earnings.

- Annual contribution: The amount you plan to contribute each year (up to the limit).

- Expected rate of return: A percentage that reflects your investment strategy.

- Annual drawdown: How much you plan to withdraw from your retirement account each year during your retirement.

- Retirement age: The number of years until you expect to retire.

3. Review the Results

Once you've entered your data, the Roth IRA calculator will display:

- Projected Balance: The estimated amount in your IRA at retirement.

- Potential Tax Savings: The potential tax savings available with a Roth IRA

- Account Balance Over Time: Shows the difference in your account balance between a Roth vs. Traditional IRA.

Roth IRA Calculator: Examples and Scenarios

To show how an Roth IRA calculator works, let’s look at a few scenarios:

Example 1: Starting Early

- Age: 25

- Starting Balance: $0

- Annual Contribution: $7,000

- Expected Rate of Return: 7%

- Years to Retirement: 40 years

- Drawdown Percent: 4%

With this scenario, your IRA could grow to $2.5 million by the age of 65. By using a Roth IRA, you could potentially save $770k when taking distributions during retirement.

Example 2: Starting Later

- Age: 40

- Starting Balance: $0

- Annual Contribution: $7,000

- Expected Rate of Return: 7%

- Years to Retirement: 25 years

- Drawdown Percent: 4%

If you start at 40, your IRA could grow to $703k by the age of 65. By using a Roth IRA, you could potentially save $215k when taking distributions during retirement.

Example 3: High vs. Low Return Rates

- Age: 35

- Initial Investment: $10,000

- Annual Contribution: $6,000

- Return Rates: 5% vs. 8%

- Years to Retirement: 30 years

- Drawdown Percent: 4%

At a 5% return, the balance at age 65 would be around $678,00 with a IRA. You could save $207,000 during your retirement years by using a Roth IRA.

At a 8% return, the balance at age 65 would be around $1.3 million with a IRA. You could save $398,000 during your retirement years by using a Roth IRA.

FAQs

How is the Roth IRA potential tax savings calculated?

This calculator estimates the amount of assets at retirement age using a constant rate of return while adjusting the annual contributions based on inflation. At the retirement age, it assumes a constant withdrawal percentage for each year of retirement through age 85. It further assumes that accumulation in a Traditional IRA will require a 25% higher withdrawal each year to satisfy a 20% income tax.

Who is a Traditional IRA best suited for?

An individual who expects to be in the same or lower tax bracket when starting to take withdrawals.

Who is a Roth IRA best suited for?

An individual who expects to be in a higher tax bracket when starting to take withdrawals.

What happens after five years in a Roth IRA?

You can withdraw your contributions at any time, for any reason, without taxes or penalties. However, if you want to withdraw earnings tax-and-penalty free, the withdrawal must meet two conditions:

- Five-Year Rule: you must have held the Roth IRA for at least five years

- Qualified Event: you must be either 59 ½ or older, permanently disabled, a first-time homebuyer (with a $10,000 lifetime limit), or withdrawing the funds by your beneficiary after your death.

If you don’t meet both of these requirements, the earnings are subject to both income tax and a 10% early withdrawal penalty.

.webp)