BOOK YOUR FREE STRATEGY SESSION

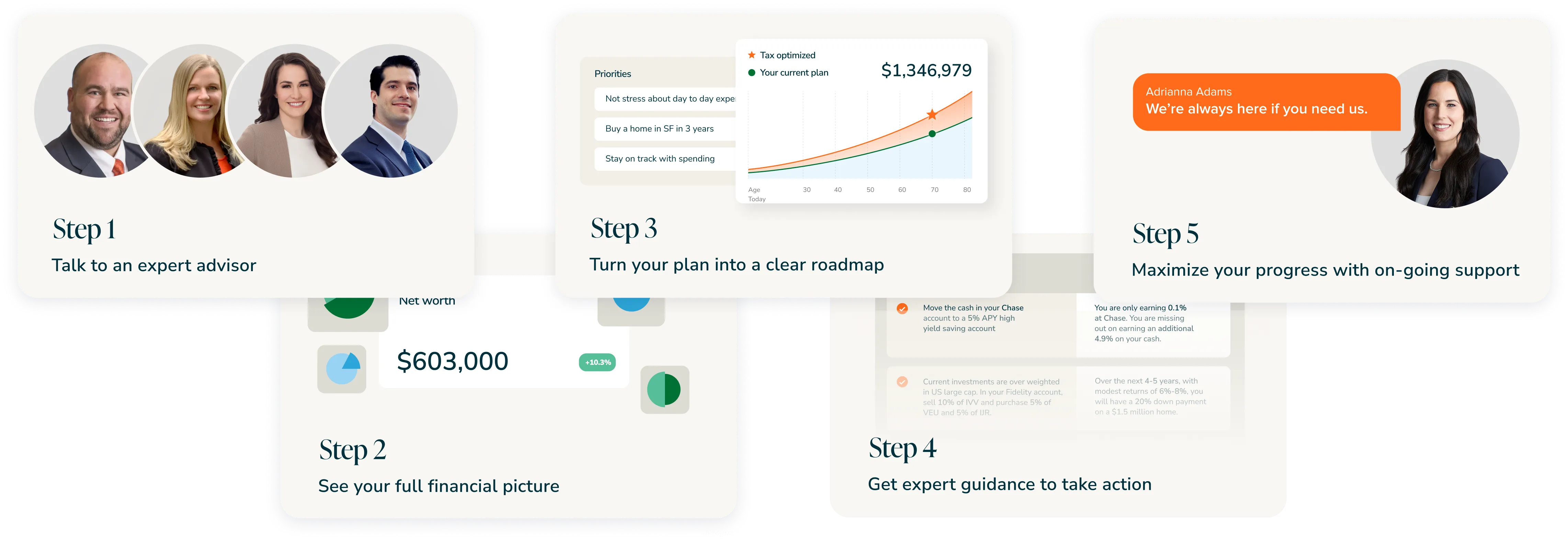

A Clear Plan Today. A Trusted Partner for Tomorrow.

Images are for illustrative purposes only

One advisor. Personalized advice from the first session.

We design a step-by-step strategy built around your life, ensuring your money works as hard as you do.

See the big picture. Understand what you own, what you owe, and what’s needed to reach your financial goals.

Test-drive your financial future. Explore different scenarios—like buying a home or getting a raise—and see how they shape your short and long-term outlook.

We track where your money goes, so you don’t have to. Get clarity on your habits—whether it’s online shopping, dining out, or travel—and see how small changes can make a big impact. Fine-tune your budget without giving up what you love.

Unlock your financial possibilities! Our analysis reveals spending and saving areas, empowering you to:

Make sure your investments are working for you—not the other way around.

Your money should support the life you want—whether that means buying a home, retiring early, or funding new opportunities.

Could you retire sooner than you think? What will it take to afford your dream house in the next three years?

You tell us what matters, we’ll help you get there.

Your 90-minute plan delivery session is where your financial strategy comes to life.

Your advisor will walk you through your customized plan, explaining each step clearly and ensuring it aligns with your goals. Nothing is set in stone—you’ll have the opportunity to ask questions, refine your strategy, and make adjustments in real time.

By the end of the session, you’ll have a clear roadmap and the confidence to take action.

See exactly what it takes to sustain your lifestyle and close any gaps that could stand in the way of your financial goals.

A simple, actionable checklist to keep you on track—because nothing feels better than making progress and crossing off the next step toward your goals.

Every recommendation is tied directly to what matters most to you—so you can see the path forward and take action with clarity.

Deep insights on what matters most to you. From tax strategies to home affordability, we analyze every angle and give you clear, actionable guidance—so you can make confident financial moves that move you forward.

.webp)

A financial plan is only useful if you put it into motion. That’s why we offer a 60-minute implementation coaching session—a dedicated time to ensure you're making progress and tackling the most important steps first.

Work through your most pressing questions or important financial decisions with your CFP® professional.

Get support in making financial moves like account setups, 401k rollovers, and budgeting.

To ensure your financial plan remains aligned with your evolving life and goals, we conduct annual plan updates. These updates empower you to:

.webp)

You’re never on your own—your CFP® professional will guide you through the process so you can make financial progress with confidence.

Your life changes. Your plan should, too.

Your Domain Money Annual Membership provides year-round CFP® professional support to keep you on track, adapt as life changes, and identify new opportunities to get the most out of your money.

Year 1: Building Your Foundation

In your first year, we take the time to get to know your whole money picture. We'll create a custom plan just for you, show you exactly what steps to take, and guide you through putting it all into action. This important first step is where we do the deep work to set up your financial future for success.

Year 2+: Ongoing Expert Guidance

After building a solid financial foundation in Year 1, we'll keep working together to help your money grow. We'll update your plan regularly, track how you're doing with your goals, and guide you through life's changes. This ongoing support ensures your financial plan stays current and helps you take advantage of new opportunities to make your money work harder for you.

Each year, we revisit your financial plan to keep it aligned with your evolving goals.

Your Certified Financial Planner (CFP®) is just a call or email away. This unlimited access ensures you are always supported, allowing you to:

Stay ahead with a proactive, evolving approach to your finances. Our ongoing strategy sessions help you navigate:

You’re never on your own—your CFP® professional will guide you through the process so you can make financial progress with confidence.

Get started building a financial plan today.